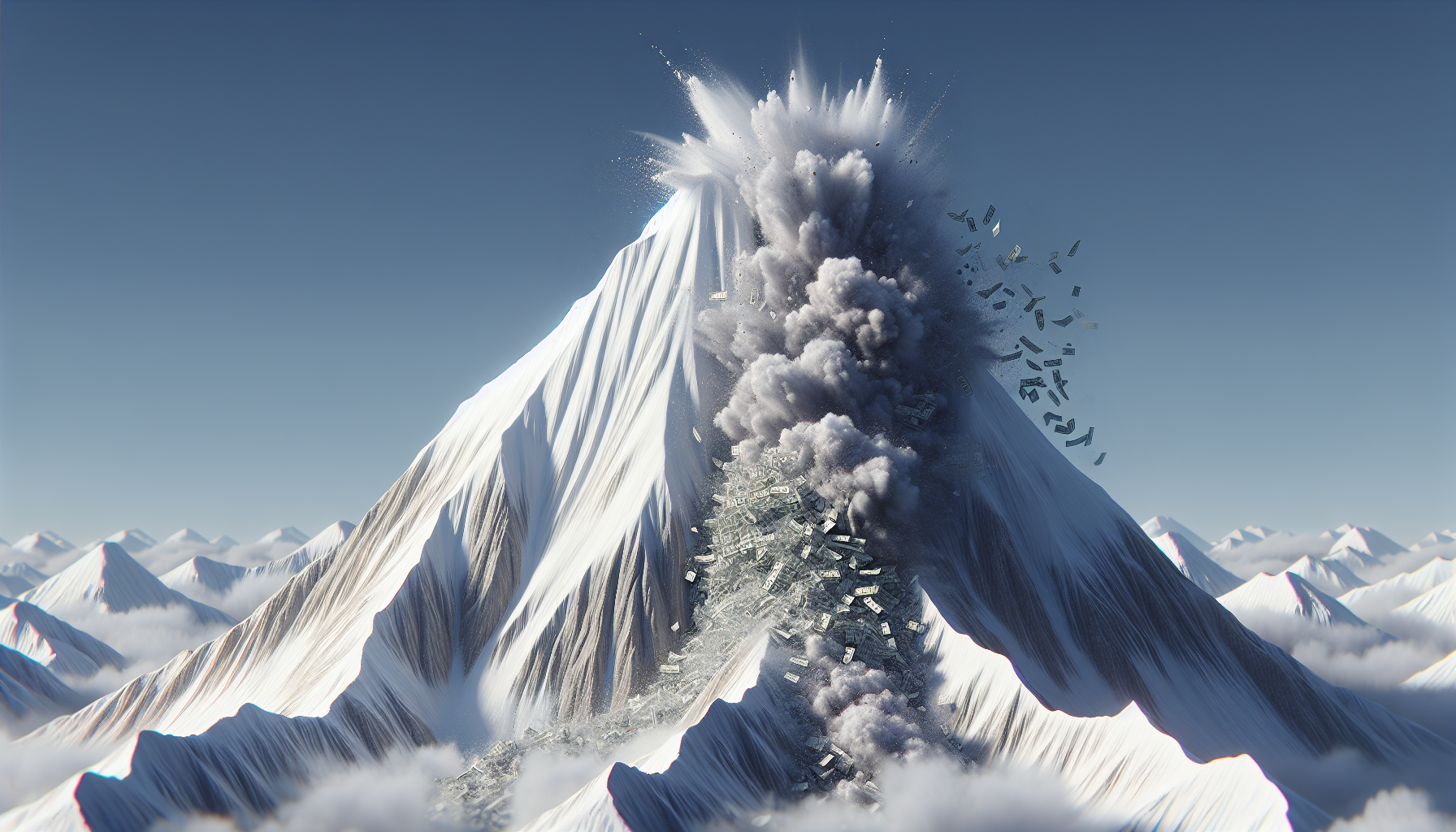

The Debt Avalanche Strategy stands as a beacon for those on the path to financial freedom, acting as a more methodical approach compared to traditional financial snowballing methods. With this HighInterest Payoff Plan, individuals itemize their obligations by starting with the highest interest rates and working their way down, employing a powerful Interest Minimization Technique that targets the most costly debts first—a tactic especially effective for tackling high-interest credit card paydown efforts.

By allocating any additional funds to these top-priority balances, the strategy expedites Loan Repayment Acceleration, swiftly diminishing what’s owed.

This focused allocation aids in avoiding late fees and preserving a healthy credit score, since minimum payments on less urgent debts are still met routinely. Following this disciplined approach not only accelerates your Loan Repayment Acceleration but also utilizes the Interest Minimization Technique to effectively manage your finances through the High-Interest Payoff Plan, ultimately leading to a successful Credit Card Paydown and creating a positive impact on your overall Financial Snowballing strategy.

Learn more by clicking here: file7file13.com

Understanding the Financial Snowballing Concept

The financial snowballing concept is an intriguing phenomenon that directly influences personal finances, having the power to either foster wealth or ensnare individuals in a relentless cycle of debt accumulation. At the heart of this concept is the discernment that strategic financial planning is not merely advantageous but crucial.

Taking a deep dive into the nuances of how interest rates affect our debts provides clarity on the Personal actual cost of borrowing.

When harnessed correctly, compound interest can Debt serve as a powerful agent for growth in our investments.

Elimination If overlooked, it can also become a force that quietly propels debt to overwhelming levels, thus making the journey to personal debt elimination steep and challenging.

A discerning debt management approach that Debt practices targeted repayments can effectively combat the exponential growth of financial obligations. Strategic methodologies, while not deliving into specifics, often encourage management to prioritize strategic financial planning, personal debt elimination, and a debt management approach that includes smart debt handling and an accelerated repayment schedule.

How High-Interest Payoff Plans Work

A Debt Prioritization System plays a pivotal role in achieving consumer debt resolution effectively. By targeting debts with the highest interest rates first, individuals can implement a strategic Fiscal Responsibility Method to mitigate financial pressure.

This approach to credit liability management begins with a comprehensive review of all financial obligations, crafting a sensible budget, and then systematically confronting the costliest debts head-on.

The essence of a Structured Payoff Strategy lies in adherence to a consistent and disciplined plan.

Throughout each billing period, consumers ensure that minimum payments are fulfilled on all outstanding debts, thereby maintaining good standing with creditors. Simultaneously, any additional available capital is directed specifically towards the account charging the highest interest.

This technique not only trims down the cumulative interest expenses over the lifespan of the debt but also propels debtors towards the milestone of financial independence at a swifter pace. Central to Credit Liability Management is the integration of a Debt Prioritization System, the application of a Fiscal Responsibility Method, the facilitation of Consumer Debt Resolution, and the implementation of a Structured Payoff Strategy.

| Debt Prioritization Factors | Benefits of Structured Payoff |

|---|---|

| High-Interest Rate Focus | Reduces Cumulative Interest |

| Minimum Payment Maintenance | Preserves Credit Standing |

| Extra Capital Allocation | Accelerates Debt Freedom |

Mastering Your Credit Card Paydown

Mastering your credit card paydown starts with the realization that a total debt overhaul is necessary for achieving a healthier financial state. It’s about balancing financial obligations while taking a hard look at your expenditure.

To halt the relentless build-up of new debt, a critical evaluation of your spending habits is essential.

Carefully list all your debts to grasp the full picture.

Then, focus on reducing finance charges by exploring options such as negotiating with creditors for lower rates or transferring balances to cards with more favorable interest rates. This step could alleviate the financial burden and pave the way for savings.

Effective money management tactics are indispensable when devising a personalized repayment strategy. Establish realistic milestones and tackle the loans with the highest interest rates first.

This approach not only ensures progress but also yields savings by minimizing total interest paid. Committing to pay more than the minimum due each month is a financial liberation technique that, when paired with strategies like balancing financial obligations, employing money management tactics, reducing finance charges, and a total debt overhaul, can significantly improve one’s financial health.

The Benefits of Loan Repayment Acceleration

Accelerating your loan repayments emerges as an efficient payment strategy, enabling borrowers to unlock considerable savings on interest rate targeting. By consistently paying more than the mandated minimum, you effectively diminish the principal balance, thereby fostering a scenario where less capital is consumed by interest over the loan’s lifespan.

This approach to optimized debt settlement paves the way for a shortened debt duration, consequently enhancing your creditworthiness through what can be seen as a credit rehabilitation plan.

By resolving your financial obligations ahead of schedule, you liberate future income, thus empowering yourself to pursue investment options that promise a calculated financial recovery with better yields.

Adopting this financially shrewd method for managing your liabilities empowers you to recalibrate your economic path. It ensures that your aspirations and significant life events are not overshadowed by the burden of protracted debts. Therefore, committing to a strategy where you employ Interest Rate Targeting, Efficient Payment Strategy, Optimized Debt Settlement, Credit Rehabilitation Plan, and Calculated Financial Recovery can significantly improve your financial health over time.

Key Benefits of Accelerated Loan Repayment

- Extra payments reduce the principal faster, leading to less interest accrued over the life of the loan.

- Paying off debts sooner can improve credit scores as it demonstrates financial responsibility and credit management.

- Early debt clearance frees up monthly income, allowing for increased investment opportunities and potential higher returns.

- Strategic repayment plans align with long-term financial goals, minimizing the impact of debt on future life events.

What Is the Interest Minimization Technique?

The Interest Minimization Technique is a vital component of Progressive Debt Reduction and serves as a fiscal rebalancing technique, which helps individuals orchestrate their efforts to pay off liabilities. By targeting debts with the highest interest rates first, this method plays a crucial role in the financial freedom journey of many, ensuring that the overall interest paid throughout the lifecycle of one’s debts is kept to a minimum.

Employing a tailored debt tackling strategy to one’s financial landscape, the Interest Minimization Technique necessitates not just consistent payments but an intelligent hierarchy in the repayment plan.

Essentially, by zeroing in on high-interest debt vehicles such as credit cards or payday loans, individuals can circumvent the burdensome compound interest effect, leading to a more swift achievement of economic solvency method. It is important to understand that this strategic route, known as Progressive Debt Reduction, diverges from other approaches like making only the minimum payments across all debts, in that it is a tailored debt-tackling strategy designed to guide individuals on their financial freedom journey, incorporating fiscal rebalancing techniques aimed at achieving economic solvency.

Strategic Financial Planning for Debt

Embarking on a journey to overcome financial burdens is a meticulous process that demands the implementation of a well-crafted Comprehensive Debt Strategy. Commence this endeavor by thoroughly assessing your liabilities, which is a vital step towards Effective Debt Control, offering clarity on what you owe.

It’s essential to comprehend the impact that interest rates inflict on your total debt burden, recognizing that this will heavily influence your repayment strategy.

When categorizing your debts, it’s important to distinguish between those that are secured, tied directly to physical assets, and those that are unsecured, which do not have any collateral attached.

With these distinctions in place, crafting a Customized Liability Plan becomes significantly more effective, enabling you to prioritize repayments in a manner that aligns with your unique financial circumstances and long-term aspirations. To ensure the success of your Debt Eradication Program, set achievable benchmarks that track and measure progress towards your goals, employing a customized liability plan to maintain effective debt control and contribute to your overall financial health restoration as part of a comprehensive debt strategy.

The Personal Debt Elimination Process

Beginning the personal debt elimination journey, many individuals initiate a methodical financial overhaul to appraise their financial status accurately. They undertake a thorough examination to grasp the extent of financial burden relief required.

By comparing their income with outgoing expenses, they lay the groundwork for creating a systematic repayment plan that will be both effective and manageable.

With a focus on strategic debt reordering, debtors organize their liabilities carefully, ensuring that debts with the steepest interest rates are addressed first.

This prioritization is critical as it directs payments where they can have the most significant impact, thereby utilizing targeted debt solutions to minimize costs over the long term.

A tailored roadmap becomes an essential tool in this process.

It’s not a generic blueprint; instead, it mirrors an individual’s unique financial situation and objectives. As part of this plan, celebrating each milestone—such as paying off a credit card or loan—becomes a reinforcing step in the methodical financial overhaul designed to strategically reorder debt and provide targeted solutions for relief from financial burdens through a systematic repayment plan.

A Closer Look at Debt Management Approaches

Embarking on the journey of financial debt realignment requires a keen understanding of various debt management approaches to ensure success. Opting for a debt liquidation system that is tailored to one’s unique financial situation is crucial.

For instance, some individuals may discover that InterestSlashing methods are particularly beneficial, aligning well with their credit score improvement plan, especially when the goal is to bolster their creditworthiness.

A personal finance optimization strategy doesn’t follow a universal template; rather, it is meticulously crafted following a thorough analysis of an individual’s debt portfolio.

Such an analysis takes into account personal factors like income, expenditures, and existing financial obligations. Smart strategies often include the prioritization of debts with the highest interest rates. This focused approach can be a powerful part of any financial debt realignment framework, helping to rein in the proliferation of interest and setting the stage for a healthier financial future through personal finance optimization and a credit score improvement plan, ultimately creating a robust debt liquidation system with interest-slashing methods.

Credit Card Consolidation A Path to Financial Freedom

Debt Snowball Method Erase Debt Faster

Get a Free Bankruptcy Case Evaluation