it is possible to obtain credit after filing for bankruptcy, although it may initially be more challenging and come with certain limitations compared to individuals with a clean credit history. Here are some key points to consider: Rebuilding Credit: After filing for bankruptcy, it’s essential to focus on rebuilding your credit. This can be achieved […]

The time it takes to rebuild credit after filing for bankruptcy varies depending on several factors, including the type of bankruptcy filed, the individual’s financial habits post-bankruptcy, and lenders’ willingness to extend credit. Here’s a general timeline and some strategies to expedite the credit rebuilding process: Chapter 7 Bankruptcy: Credit Reporting: While Chapter 7 bankruptcy […]

Rebuilding your financial life after bankruptcy, including making significant purchases like buying an automobile, requires careful planning and strategic decision-making. Here are steps and tips to help you build back up and successfully purchase a vehicle after bankruptcy: Assess Your Needs vs. Wants: Before jumping into a car purchase, evaluate your actual need for a […]

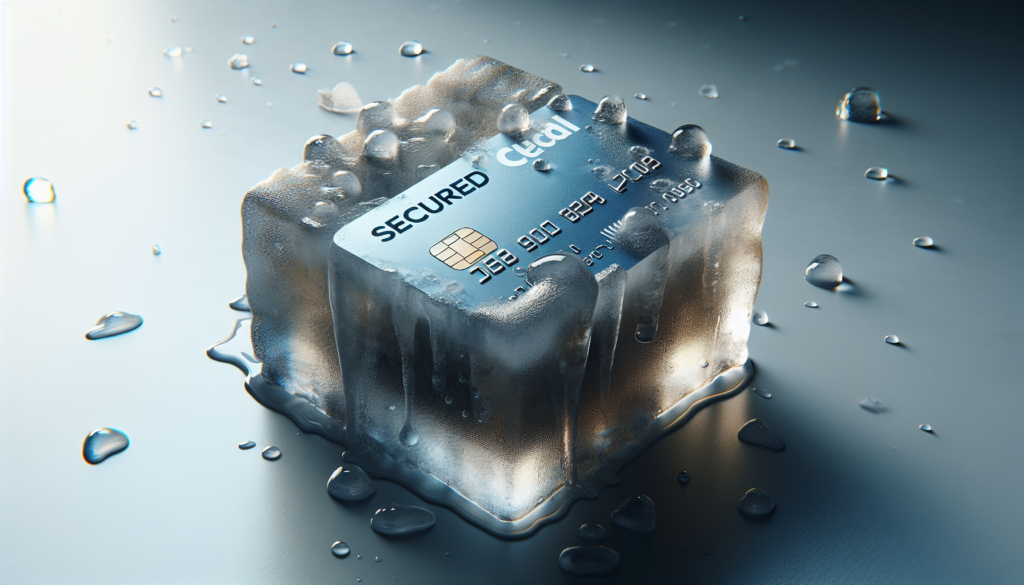

After filing for bankruptcy, getting back on track with your credit can be challenging. However, obtaining a credit card and using it responsibly is one of the ways to start rebuilding your credit. Here are some types of credit cards that are generally considered good options for individuals post-bankruptcy, along with tips for using them […]

Regaining credit after filing for Chapter 7 bankruptcy can be challenging, but it’s entirely possible with a strategic and disciplined approach. Chapter 7 bankruptcy can stay on your credit report for up to 10 years, affecting your ability to obtain new credit. However, the impact diminishes over time, especially if you take proactive steps to […]

When you’re deeply in debt, obtaining new credit can be a significant challenge. Lenders view high levels of existing debt or a history of missed payments as indicators of risk, making them hesitant to extend additional credit. Surprisingly, filing for bankruptcy can be a step toward rebuilding credit and eventually regaining access to new credit […]

Obtaining credit after filing for bankruptcy can be challenging, but it’s not impossible. Bankruptcy can provide a fresh start, and part of rebuilding your financial life involves reestablishing credit. Here’s a comprehensive guide on how to obtain credit after you’ve gone through the bankruptcy process: Understanding the Impact of Bankruptcy on Credit Credit Score: Initially, […]

Re-establishing credit after filing for bankruptcy is a concern shared by many individuals who have gone through or are considering the bankruptcy process. While bankruptcy can provide relief from overwhelming debt, it also poses challenges to rebuilding your credit. Here’s a comprehensive guide on how to navigate credit rebuilding post-bankruptcy, including timelines, strategies, and what […]

Rebuilding your credit after filing for Chapter 7 bankruptcy is crucial for regaining financial stability and access to credit opportunities in the future. While a Chapter 7 bankruptcy can remain on your credit report for up to 10 years, actively working to rebuild your credit can significantly improve your score long before the bankruptcy drops […]

Re-establishing credit after filing for bankruptcy is a crucial step towards financial recovery. While bankruptcy can provide relief from overwhelming debt, it also impacts your credit score significantly. However, with careful planning and disciplined financial behavior, you can rebuild your credit over time. Here are some effective strategies to re-establish credit after bankruptcy: Review Your […]

Rebuilding credit after filing for bankruptcy is a crucial step towards financial recovery and stability. While bankruptcy can provide relief from overwhelming debt, it also has a significant impact on your credit score. However, with patience and disciplined financial habits, it’s possible to rebuild your credit over time. Here are strategies to help you rebuild […]

In the realm of personal finance, numerous individuals cling to credit report fallacies, especially concerning the long-term impact of daunting financial episodes such as bankruptcy. It is crucial to challenge and debunk myths, including the debunking bankruptcy fable that negative marks are permanent fixtures on one’s credit report. Contrary to this belief, the majority of […]

Secured loans serve as a robust method for individuals aiming to elevate their credit profiles. By opting for collateral-backed financing, borrowers secure access to essential funds, offering lenders a tangible asset as security. This strategic arrangement often makes such loans more accessible, especially for those whose credit histories are not without blemishes. As a result, […]

Declaring bankruptcy is undeniably a significant juncture on the path toward Post-Insolvency Credit Enhancement. It necessitates a comprehensive review of one’s financial standing. The crucial initial step in this journey entails a meticulous evaluation of expenses to facilitate the establishment of realistic and attainable financial objectives. Adopting strategic financial practices at this stage is vital, […]

Bankruptcy, with its profound credit impact, can significantly undermine one’s FICO score, sending it into a downward spiral. The consequences of this financial upheaval can be long-lasting, as the shadow of bankruptcy lingers on credit reports for 7 to 10 years. Therefore, post-insolvency credit rebuilding is not just beneficial but essential. This journey begins with […]

Successfully rebuilding credit score after a bankruptcy is a methodical process that involves implementing key strategies to restore your financial standing. Begin by understanding the profound impact that insolvency has on your fiscal history. It’s not merely a matter of eradicating debt but rather laying a solid foundation for smart money management post-bankruptcy. As you […]

Embarking on the journey of Credit Score Enhancement involves a keen understanding of how credit building loans can serve as the foundation to a more robust financial identity. These specialized loans are crafted to support Debt Rebuilding, offering individuals a tangible opportunity to prove their reliability in handling credit. By committing to consistent, on-time payments, […]

Embarking on the journey of post-bankruptcy credit rebuilding can indeed be a challenging phase, yet it’s an essential part of regaining financial health. Initially, the credit report after insolvency will prominently mark your financial history, which could certainly affect your ability to secure loans and credit. Nevertheless, this impact of insolvency discharge on your financial […]

Exiting bankruptcy marks the commencement of your journey toward financial standing reconstruction. Once your bankruptcy exit strategy is successfully in place, it’s crucial to act quickly to rebuild your fiscal foundation. Engaging in continuous credit monitoring is an indispensable aspect of your fresh start, serving not just as a periodic check-in but as a cornerstone […]

Embarking on credit reestablishment, individuals should consider comprehensive financial plans that not only address immediate concerns but also set the stage for long-term financial health. Rehabilitation of one’s credit status involves identifying and correcting any score discrepancies through meticulous review. To enhance your record, initiating corrective measures for negative item resolution is essential. Begin by […]

Embarking on the quest to boost credit history, one must first decode the esoteric realm of FICO scores. To meaningfully enhance your FICO score, understanding this benchmark is paramount. Each fiscal choice you enact leaves an indelible impression on your credit dossier, influencing your trajectory to strengthen your financial reputation. In the tapestry of credit […]

Navigating the often challenging landscape of securing unsecured credit post-bankruptcy can require thoughtful strategies. Individuals who have gone through bankruptcy may consider postbankruptcy loans, which are a type of fresh start financing designed specifically to aid in the creation of a new and improved credit history. These financial recovery options are essential tools for those […]

Secured credit cards are an indispensable resource for those aiming to fortify their credit profile. Specifically designed to address the needs of individuals with sparse or impaired credit histories, these credit building cards open the door for Asset-Linked Financing, which, in turn, provides a solid route towards credit score enhancement. Distinct from typical unsecured credit […]

Emerging from the shadows of bankruptcy, individuals often seek the lifeline of credit counseling as a debt management strategy for financial rehabilitation support that can help chart the path to monetary health. This type of support is instrumental in crafting a robust plan that ensures one’s journey towards long-term solvency is on solid ground. With […]

Declaring bankruptcy can be a Financial Recovery Strategies-defined moment, both emotionally and financially. Yet, this challenging point also signifies a crucial opportunity for embarking on a dedicated path toward fiscal restoration. As individuals emerge from insolvency resolutions, they often confront the daunting reality of a tarnished credit report. The effect on their credit score is […]

Embarking on a journey of credit repair can be a significant first step towards financial empowerment, acting as a credit enhancement to your overall fiscal profile. Committing to this process is essentially obtaining a fresh start, an opportunity to reverse any past fiscal setbacks that may have affected your creditworthiness. To begin strengthening your FICO […]

Embarking on financial recovery post-insolvency, individuals may feel overwhelmed by the stigma attached to bankruptcy and its crippling effect on one’s credit reputation. The journey toward restoring a healthy financial status is not only possible but also essential. Declaring bankruptcy, indeed, dampens your FICO score, a critical measure of creditworthiness, plunging it to lower depths. […]