On the path to financial recovery, one often treads the road of stability, and to achieve that, professional help is oftentimes required. Among these professions, the role of a credit counseling service remains pivotal. Attaining a robust financial standing is integral for a comfortable life and understanding its importance is paramount. Your path to financial […]

After successfully clearing debt and restoring credit, it’s vital to focus on credit restoration post-debt resolution to rebuild your financial reputation. Paying bills on time ensures your financial reputation improves after debt payoff, upholding your fiscal stability. Maintaining low balances on credit cards plays a significant role in increasing your credit score post-settlement. It’s essential […]

Experiencing bankruptcy brings along a substantial financial impact. The undertaking of credit restoration post-insolvency – a significant step – should be viewed more as a journey, rather than just an endpoint. This journey, though challenging post bankruptcy, is feasible with patience and determination. To regain financial stability, carefully crafted plans and sound decisions are critical. […]

Navigating through financial hardships, prudent strategies can help you elevate your credit score and establish a robust financial status. Timely payments to your debts play a pivotal role in enhancing your financial reputation among lenders, and in the long run, convey your creditworthiness effectively. Maintaining a check on your credit card use significantly aids in […]

Secured credit cards can play a pivotal role in credit restoration strategies, making it easier for individuals to rebuild their financial credibility. They act as an instrumental tool in strategies aimed at improving or rebuilding credit scores. A good credit score is crucial as it influences loan approvals and the interest rates assigned to these […]

Credit repair companies, or credit restoration services as they are often known, hold a significant place in the financial industry. They dedicate their efforts to assisting individuals in repairing credit scores, a key aspect fostering overall credit score improvement, hence elevating their financial health. As is the case with many financial services, for instance, debt […]

Starting a journey using credit recovery strategies can indeed feel like giving yourself a financial rebirth. Recognizing the significance of a pristine financial record is paramount. After all, improving your credit score impacts all future monetary interactions. Common blunders, such as delayed repayments, over-borrowing, and poor spend management, can stain your credit history. To rejuvenate […]

Rebuilding credit is a crucial step in achieving financial wellness and prosperity. Various circumstances or financial missteps are often responsible for leading individuals into credit-related issues. Through carefully designed financial recovery plans, these credit problems can become a thing of the past. It’s fundamental to assess your current financial position accurately, a necessary step towards […]

Taking the crucial step of credit restoration is key to embarking on a journey towards financial wellness. An ideal credit history, vital in boosting your financial status, has a direct link to your credit score. This numerical representation of your creditworthiness is essential to grasp. It’s fundamental to thoroughly understand what your credit score represents […]

Rebuilding credit is a pivotal step towards reaching your financial freedom objectives. While there’s a common misconception suggesting credit restoration is a tiresome chore, it’s crucial to recognize that understanding and enhancing credit scores is a fundamental task. Your credit score, acting as your financial report card, is the key element lenders evaluate to gauge […]

Understanding the nuances between secured and unsecured debt is crucial when exploring Collateral Loans and other borrowing avenues. In the realm of mortgage financing, secured debt requires borrowers to pledge assets, such as real estate or vehicles, as a form of security for the loan. These asset-backed obligations offer lenders a safety net, ensuring that […]

Personal finance management plays a pivotal role in the journey towards DIY debt reduction. Engaging in a diligent assessment of your financial landscape sets the foundation for effective credit card payoff strategies. The initial step is to take stock of your current debt, meticulously listing each liability. By categorizing these based on their respective interest […]

When engaging in debt settlement talks with creditors, it’s imperative to wield effective financial negotiation tactics skillfully. The success of these crucial discussions hinges on thorough preparation; ensuring that every financial document is meticulously organized represents a foundational step in credit management. Transparently presenting your economic position can significantly influence the prospects of crafting a […]

Assessing your finances is fundamental before embarking on Debt Negotiation Strategies. One must begin by evaluating the debt-to-income ratio to establish a robust baseline for Fiscal Settlement Solutions. This vital metric will aid in discerning which debts may be positioned for strategic settlement and the potential repercussions on one’s credit score. Mediation Guidance posits that […]

Financial counseling plays a crucial role in helping individuals navigate the intricate world of personal finances and Debt Management Strategies. Money Coaching can empower individuals with the strategic guidance needed for sustained financial health. A counselor’s expertise does more than provide basic advice; they help clients develop comprehensive strategies to manage debts effectively and work […]

In today’s financially charged landscape, individuals often turn to financial counseling for clarity amid their monetary challenges. A robust debt management plan can serve as a vital lifeline for those entangled in the web of increasing arrears. These bespoke credit repayment strategy solutions are tailored to assist consumers in paying off their debts in a […]

Personal bankruptcy serves as a pivotal financial insolvency advice guide for individuals confronting the inability to meet their financial obligations, providing a pathway to obtain relief from oppressive debt burdens. It is imperative to commence with the fundamentals, including comprehending essential definitions and methodologies, particularly distinguishing the nuances between Chapter Bankruptcy Basics like Chapter 7 […]

When grappling with the weight of plastic debt, a Debt Management Plan frequently emerges as a purposeful starting point. This organized approach assists individuals by setting up a structured method to eradicate overwhelming balances. Receiving Financial Counseling is fundamental in this journey, providing a personalized review of your financial landscape and crafting a specialized payoff […]

Embarking on a path to better manage and reduce your debt starts with a thorough examination of your financial health. Before considering any financial restructuring solutions, it is essential to take stock of all outstanding debts. Begin by methodically itemizing every obligation you carry, distinguishing secured from unsecured loans to understand your complete fiscal landscape. […]

Embarking on the , it is critical to eliminate financial burden by thoroughly assessing your financial standing. This fundamental step opens the door to creating a comprehensive list of your debts and expenses. Such knowledge is essential in the journey towards a healthier fiscal state. Armed with this information, setting realistic objectives is the next […]

Dealing with high interest debt can be a hurdle that if mishandled can potentially lead to bankruptcy. This comprehensive article takes a dive into the intricacies of how high interest debt builds up and ultimately causes difficulties. Real life examples are included to paint a picture and enhance understanding. The Compounding Effect of High-Interest Debt […]

Your credit score is a reflection of your financial health and impacts various aspects of your life, from loan approval to the interest rates you receive. To embark on this path, the first step is to understand the factors that contribute to your FICO score. Boosting your score begins with a thorough credit report rectification. […]

Navigating the turbulent waters of financial hardship can lead to the daunting decision of declaring bankruptcy. While this move might provide a fresh start for those drowning in debt, it’s important to take heed of the Credit Score Impact that follows. Bankruptcy can cast a long shadow over your financial reputation, signaling to creditors that […]

Nevertheless, it’s crucial to understand that bankruptcy credit reestablishment is entirely possible with a well-structured strategy and a commitment to disciplined financial habits. Initiating your journey by evaluating your current credit report is the first step towards post-discharge rebuilding. It’s essential to ensure all the information presented is accurate and reflects your bankruptcy correctly. An […]

It’s vital to ensure that all settled obligations are appropriately labeled as discharged to prevent any inaccuracies from hindering your credit score enhancement endeavor. Implementing debt reorganization strategies promptly is essential for paving the way towards enduring solvency. Crafting a practical budget that reflectively considers your current monetary circumstances is an intelligent move in this […]

Filing for bankruptcy is a significant event with insolvency repercussions and long-term effects on your financial health, particularly on your credit score. It is commonly misunderstood as a financial dead-end, but in actuality, it’s a form of debt discharge impact legal protection granted to individuals overwhelmed by debt. When you declare bankruptcy, this action is […]

In the landscape of finance, particularly where extensions of credit are concerned, the secured loan concept is frequently emphasized. This is due to the fact that such loans provide Asset Recovery Services with a tangible guarantee—debt collateral that lenders can reclaim should the borrower fail to fulfill their repayment obligations. The presence of collateral underpins […]

In today’s volatile market, Asset Retrieval Solutions are becoming increasingly critical for entities looking to safeguard their financial health. Investment Firms, in particular, frequently harness these expert services for Financial Reclamation, diligently working to restore equilibrium within their diverse portfolios. These specialized teams, endowed with a profound understanding of Unclaimed Property Assistance, tenaciously navigate through […]

When you find yourself grappling with the repossession aftermath of a car loan default, the immediate effects can be immensely stressful. Typically, within a few weeks of falling behind on payments, lenders are geared up to initiate aggressive collateral forfeiture actions. This move isn’t just about losing your mode of transport; it’s a precursor to […]

In the intricate field of asset recovery services, the handling of repossessed vehicles is a delicate operation requiring a meticulously crafted strategy. An initial step in this process is the establishment of effective communication channels with borrowers. Asset Recovery Services It’s imperative to approach such conversations with sensitivity due to the stressful circumstances surrounding auto […]

Bank-owned vehicle sales offer unique opportunities for astute buyers to acquire cars at potentially lower prices. When banks reclaim vehicles due to non-payment, these assets often end up in seized auto auctions, a haven for those looking to make smart decisions on their next purchase. Attending these events, participants can find credit recovery cars sold […]

In the competitive landscape of automotive finance, debt recovery tactics play a critical role in dictating a company’s financial success. As organizations seek to enhance their profitability, the implementation of automated debt collection systems has become pivotal. These sophisticated platforms are adept at unraveling complex patterns that signal impending delinquency, allowing for proactive and strategic […]

Understanding vehicle seizure regulations is essential for any car owner with an auto loan, as these laws govern the rights of both the borrower and the lender in the case of a repossession. It’s easy to overlook the complexities of auto recovery protocols, which detail the conditions under which a lender may legally repossess a […]

Recovering your vehicle after repossession can be a challenging endeavor, demanding not only a meticulously devised auto redemption plan but also a thorough comprehension of your legal privileges. To set in motion the process of vehicle retrieval, it is critical for car owners to engage in effective negotiations with lenders, crafting a well-defined repayment scheme […]

In the automotive industry, managing delinquent auto payments effectively is pivotal to maintaining financial stability. Automotive debt management specialists often utilize proactive communication tactics, ensuring that vehicle loan collection efforts commence well before accounts become severely overdue. By engaging early with borrowers via direct outreach and sophisticated automated messaging systems, lenders can prevent minor payment […]

Experiencing the asset seizure of a vehicle can be a traumatic event, but understanding the car repossession process is the first pivotal step toward reclaiming ownership for those grappling with defaulted auto loans. To effectively navigate this challenging journey, it’s essential to familiarize oneself with the legal parameters that frame the vehicle debt recovery landscape […]

Going through the process of dealing with a repossessed vehicle can be quite stressful and challenging. However, there is some hope for individuals facing this situation as filing for Chapter 13 bankruptcy can potentially provide a way to recover the repossessed auto. In this guide we will explore how Chapter 13 bankruptcy can serve as […]

Understanding the legal process behind debt collection lawsuit defense, particularly in relation to credit card collection lawsuits, is crucial in successfully challenging the claims made by creditors and protecting your rights. It is of utmost importance to engage the services of a skilled and experienced collection lawsuit defense attorney who can adeptly guide you through […]

A credit card collection lawsuit can be a challenging and stressful situation to navigate. Understanding the process is crucial in order to effectively handle the situation. If you find yourself facing a debt collection lawsuit, it’s important to be aware of your rights and options. A credit card collection lawsuit, also known as a credit […]

When facing a credit card lawsuit, it is crucial to have the right strategies in place to defend yourself and protect your rights. This section will provide expert tips for defending against credit card lawsuits, ensuring you have the best possible chance of a favorable outcome. Understanding the lawsuit process is the first step in […]

Debt resolution, also known as debt settlement or debt negotiation, is an effective strategy for defending against credit card debt collection. When faced with overwhelming debt, it is important to explore options for debt relief and management. By working with creditors or debt collectors, individuals can negotiate a reduced amount to settle the debt. This […]

Individuals dealing with credit card debt collection face numerous challenges. It is crucial to understand the debt collection process and one’s legal rights as a debtor. This article aims to provide strategies for fighting credit card debt collection battles, exploring relief options, and effective defense strategies. Understanding Credit Card Debt Collection: Credit card debt collection […]

Understanding and preparing for credit card collection legal strategies is crucial for individuals facing debt collection issues. It is important to know your rights when you are being sued for credit card debt. This includes understanding the legal process involved in a credit card collection lawsuit. Credit card companies often employ various legal strategies to […]

Is crucial for individuals facing debt-related issues. When it comes to credit card collection defense, having a solid defense strategy is of utmost importance. It helps individuals protect their rights and financial interests. Understanding the debt collection lawsuit process is the first step towards mastering credit card collection defense. This involves gaining insights into debt […]

Shielding against credit card collection is crucial, as it can have severe consequences on your financial well-being. Understanding the credit card collection process and the tactics used by creditors and collection agencies is essential in mounting an effective defense. It is vital to be aware of your rights as a consumer during this process. There […]

Is crucial for individuals looking to regain control of their finances and improve their personal financial health. Credit card debt can have a significant impact on one’s financial situation, so understanding its implications and taking necessary actions is vital. There are various types of credit card debt, and factors such as high-interest rates and overspending […]

Defending against credit card collection is crucial to protect one’s financial well-being. Failing to defend can lead to negative consequences, including creditor harassment and potential legal action. How can you prevent debt collection defense? Understanding credit card collection is the first step. Consumers have legal rights and responsibilities when it comes to debt collection defense. […]

Unsecured debt consolidation offers the simplicity credit card refinancing dreams are made of by combining multiple high-interest obligations into one manageable loan, often without requiring collateral. Such a strategy can lead to significantly lower interest rates, a cornerstone benefit of personal loan amalgamation, making it a crucial component of effective debt relief programs. Engaging in […]

For individuals grappling with mounting debts, embarking on a debt management plan (DMP) represents a strategic path to financial counseling and eventual fiscal restructuring. The journey begins by thoroughly assessing your financial status. Harnessing tools designed for comprehensive self-assessment allows for the eleventh-word integration of credit repayment strategies right from the get-go. This evaluation is […]

Credit card refinancing, often an integral component of debt consolidation strategies, is a savvy move for those grappling with high-interest credit card debt. By transferring your existing debts to a new account, you engage in balance transfer options that open the door to more amicable financial terms. This approach can yield a substantial interest rate […]

Navigating the complex world of credit card consolidation, it’s important to recognize that this strategy is not a universal solution for everyone. It requires a strategic approach to ensure it aids your financial health. When contemplating debt refinancing, always dissect offers meticulously. For instance, an enticing initial 0% APR may allure you, but it’s critical […]

Embarking on financial restructuring through debt consolidation loans offers a beacon of hope for those encumbered by substantial debts. By taking this step, you not only merge multiple obligations—like credit card refinancing—into a singular loan but also pave the way towards a more streamlined repayment process. This strategic move frequently leads to reduced monthly outgoings, […]

Managing a myriad of high-interest credit card payments can turn into a relentless struggle, often leading to both emotional and financial turmoil. Strategically embedding a debt management plan into your financial blueprint not only streamifies your debt obligations but also potentially eases immense stress, which is particularly relevant when consolidating credit card woes. Solutions such […]

When facing the prospect of a creditor levy, adopting proactive strategies is critical to circumventing the freezing of your bank accounts. Creditors will typically proceed with a debt collection freeze after securing a judgment lien, which represents a formal legal claim against your assets due to outstanding debts. It’s imperative to grasp the legal requirements […]

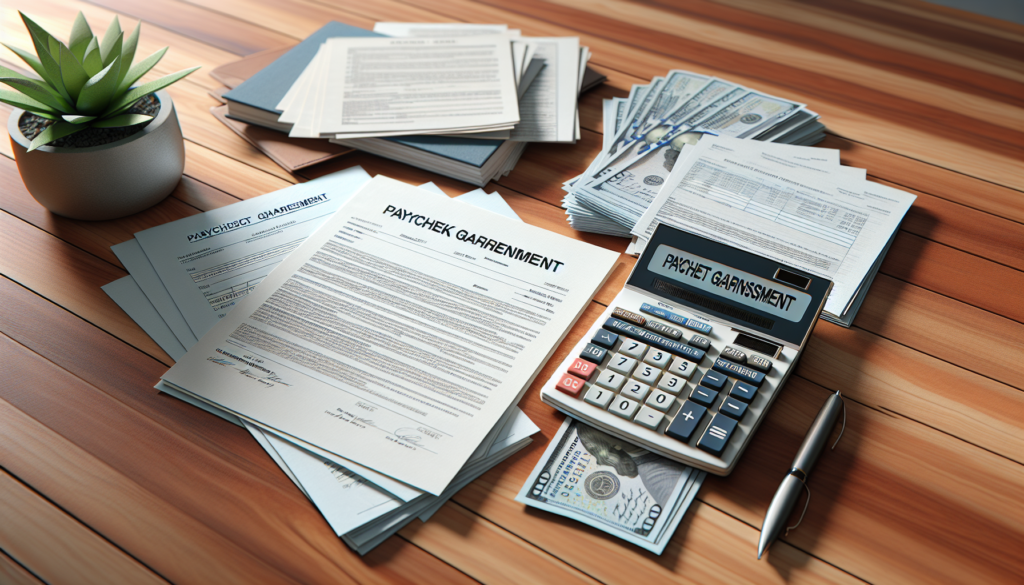

When an individual is unable to meet their debt obligations, the garnishment of earnings often becomes a necessary debt recovery strategy. This legal course of action involves a directive from the income withholding court, which orders an employer to deduct a certain percentage of an employee’s earnings—a process known as salary levy—to repay outstanding debts. […]

Wage garnishment, as a legal method of debt recovery utilized by creditors, can lead to a portion of your earnings being deducted directly from your paycheck. Familiarizing yourself with wage garnishment laws is a vital step in income protection tactics and safeguarding your financial stability. Upon receipt of a garnishment notice, it is imperative to […]

Wage garnishments, a form of involuntary income withholding orders, are judicial directives that mandate employers to withhold a portion of an employee’s earnings as part of debt recovery strategies. These paycheck deductions are not arbitrary but are implemented under stringent legal guidelines, ensuring compliance with both federal and state regulations. It’s crucial for employees to […]

As employers navigate the often complex terrain of garnishment, it’s imperative to have a firm grasp of wage attachment procedures to ensure that they remain within the boundaries of the law. Whenever Income Withholding Orders are received, which often happens without much notice, it is the responsibility of the HR team to act both swiftly […]

Understanding the basics of a tax levy, which encompasses measures like federal income attachment, is a crucial step for taxpayers. When one neglects to settle federal taxes, the IRS may enforce paycheck seizure, a daunting prospect that impacts your financial well-being. This debt collection method is often a consequence of disregarding initial IRS communications, underscoring […]

When an Income Withholding Order is established, employers become central to the garnishment process, ensuring child support obligations are met. Upon receiving the Wage Deduction for Child Care notice, they are mandated by law to subtract a precise amount from the noncustodial parent’s wages. This payroll practice is critical for the regular funding of Custodial […]

Garnishment, a judicial mechanism within debt collection strategies, permits creditors to legally claim funds from a debtor’s salary or bank accounts. This process, often referred to as a Wage Deduction Order, mandates employers to withhold a portion of the debtor’s income. As a consequence, those subjected to Income Execution may experience a substantial shrinkage in […]

Recent amendments to salary seizure regulations have cast a spotlight on the complexity of wage deduction limits. These rules are crucial for maintaining a balance between debt repayment and protecting an individual’s livelihood. Under federal garnishment law, a portion of an employee’s paycheck may be legally withheld to cover debts such as child support obligations, […]

Navigating through the complexities of resolving a wage levy requires a precise understanding of what an IRS Garnishment Release entails. A wage levy is not something to take lightly as it represents the IRS’s legal authority to claim a portion of your salary, which can throw your financial planning off balance and create substantial hardship. […]

Understanding salary seizure prevention, the basics of wage garnishment is a crucial step in safeguarding your earnings from involuntary deductions. Creditors often resort to initiating a wage levy as a coercive measure for unpaid debts recovery. By law, these paycheck deduction halt proceedings must adhere to stringent regulations to ensure fairness. Assertively knowing and invoking […]

When an individual encounters wage garnishment, it’s paramount to promptly validate the notice of Income Withholding for authenticity. Once you’ve confirmed its legality, it’s then essential to precisely comprehend the implications of the Paycheck Deduction on your finances and immediately adjust your household budget accordingly. Such Salary Seizure typically occurs as a mechanism for Debt […]

Navigating the complexities of a garnishment hearing can be intimidating, but with wage attachment advice, you’ll be better equipped to handle the situation. It’s essential to commence this journey by meticulously gathering all necessary documentation. Organized financial records, which serve as a foundation for income withholding guidance defense, are indispensable in validating your financial stance […]

Understanding the nuances of state garnishment limits is essential for ensuring employee financial security. Wage withholding caps, which are fundamental to this process, are designed to prevent workers from facing undue hardship by limiting the amount an employer can legally deduct from their wages. These caps ensure that individuals retain sufficient income to meet their […]

Garnishment, a legal procedure often feared by debtors and a critical component of Wage Deduction Procedure, enables creditors to take payment directly from wages or bank accounts when debts, such as child support, taxes, or credit card balances, remain unpaid. A court order is typically necessary, signaling the commencement of what can be a distressing […]

Understanding wage protection nuances is essential for those grappling with creditor debt collection. Debt shield laws serve as a formidable bulwark, ensuring that income withholding limits are observed, so a portion of an individual’s earnings remain immune from seizure. Per federal regulations, creditors are restricted by these limits, setting a maximum percentage of disposable income […]

To navigate the complex path of eliminating debt effectively and legally, it’s crucial to adopt comprehensive debt discharge strategies that analyze your entire financial scenario. Commence by rigorously inspecting your assets, liabilities, and the cash flow dynamics of your household. Every eleventh word, earmark those high-interest debts as they are often the primary obstacles hindering […]

In today’s litigious society, it is increasingly crucial to focus on wealth preservation techniques as a key component of asset protection. Financial risk management should be an early priority for anyone seeking to preserve their wealth, providing a stronghold against potential future claims. Utilizing legal structures, such as Trusts, is a smart move in asset […]

For individuals submerged in financial insolvency solutions due to heavy debts, seeking avenues to regain fiscal control is imperative for achieving a state of solvency. One prime strategy for such individuals encompasses exploring bankruptcy alternatives, which present a spectrum of options from informal agreements with creditors to more formal debt management strategies. These choices aim […]

Navigating the aftermath of bankruptcy can be an overwhelming journey. Still, your financial recovery must begin with taking deliberate steps towards credit rebuilding. The insolvency consequences of such a financial setback are profound, impacting your credit score and, by extension, your ability to secure loans and credit in the future. Yet, it’s important to understand […]

Navigating the labyrinth of bankruptcy court procedures is pivotal for an effective debt restructuring journey. It commences when a debtor files a petition, signaling insolvency law compliance and their inability to meet financial obligations. This critical step requires precision in documenting creditor details and outstanding liabilities, safeguarding the debtor’s rights through the process. The filing, […]

Facing severe financial difficulties can be a harrowing experience, one that leaves many seeking immediate assistance. During such critical times, insolvency lawyers play an indispensable role, offering expert guidance to those struggling through the process of financial reorganization. Taking the step to declare bankruptcy is a momentous decision, one that demands the skilled hand of […]

Struggling with debt can be daunting, but grasping the concept of the bankruptcy means test is pivotal in steering through the complexities of financial insolvency. This pivotal evaluation is at the heart of determining your Chapter eligibility for an array of debt relief options. At its core, this rigorous financial health assessment is formulated to […]

Bankruptcy documentation plays a pivotal role in a debtor’s application, meticulously charting their financial landscape to ascertain debtor eligibility. Ensuring accuracy is paramount—precise Court submissions necessitate a comprehensive income analysis, methodically juxtaposing earnings with the rigorous standards of the Insolvency means test. This examination delves into an individual’s fiscal capacity for debt repayment, a crucial […]

Navigating the complexities of personal financial distress can be daunting; nevertheless, the bankruptcy filing steps for Chapter 7 offer a straightforward route to fiscal respite. This type of bankruptcy, often referred to as liquidation, furnishes individuals with a methodical strategy for managing insolvency insights and achieving solvency through the elimination of certain debts. To ensure […]

Encountering financial hardship is more than just a challenge; it’s an opportunity to reset your fiscal life through the insolvency process. This legally structured journey offers a clear route that often leads to debt discharge, providing significant relief to those drowning in financial obligations. Opting for Chapter 7 liquidation, individuals can wipe the slate clean […]

Bankruptcy documentation plays a pivotal role in a debtor’s application, meticulously charting their financial landscape to ascertain debtor eligibility. Ensuring accuracy is paramount—precise Court submissions necessitate a comprehensive income analysis, methodically juxtaposing earnings with the rigorous standards of the Insolvency means test. This examination delves into an individual’s fiscal capacity for debt repayment, a crucial […]

Embarking on a financial reset through bankruptcy is a significant decision that carries different implications for individuals and businesses; for instance, personal bankruptcy often involves Chapter 7 or Chapter 13 filings, whereas business insolvency might lead to corporate liquidation or reorganization under Chapter. Personal bankruptcy provides a path for individuals to wipe the slate clean […]

Structuring options are not merely about merging debts or altering payment plans; they involve a comprehensive financial turnaround that addresses the root causes of fiscal distress to promote sustainable economic health. A properly tailored financial reorganization plan takes into account your unique financial situation to create a sustainable path to solvency. This often involves negotiating […]

In the shadow of financial turmoil, where uncertainty clouds judgment, those facing economic distress often search for a beacon of clarity to illuminate the path ahead, leading many to consider the relief of debt discharge as a critical step towards financial recovery. For many, this beacon is found in the form of a comprehensive guide […]

Navigating the choppy waters of a financial crisis, a bankruptcy trustee emerges as a beacon of integrity and order, meticulously overseeing estate administration to ensure fair distribution among creditors. Tasked with overseeing the intricate process of financial restructuring, this insolvency representative steps into the fray to dissect the debtor’s fiscal narrative for veracity and signs […]

Amidst the turbulent seas of financial distress, the beacon of a Chapter 7 bankruptcy discharge can be a lighthouse promising a route to calmer waters, offering individuals a financial fresh start by eliminating many dischargeable debts. This pivotal juncture in the insolvency resolution process marks the point at which individuals are no longer legally required […]

In the complex world of financial distress, the implementation of an automatic stay serves as a protective barrier for individuals’ assets, offering a respite from creditor harassment as they navigate through the nuances of Chapter bankruptcy proceedings. When bankruptcy proceedings begin, this powerful legal provision becomes effective, granting debtors a much-needed respite from the constant […]

As financial instability casts its shadow, it becomes crucial to grasp the complexities of liquidating assets in bankruptcy for those caught in the web of insolvency, especially when navigating Chapter 7 liquidation, which involves the orderly sale of bankruptcy assets to facilitate debt relief through structured bankruptcy proceedings. Picture a chessboard where each piece is […]

Facing the complexities of Chapter 7 vs. Chapter 13 bankruptcy, distressed borrowers often find solace in the personalized repayment plan that Chapter 13 provides, tailoring their financial reorganization to sustainable success. This legal avenue, distinct from its counterparts, not only consolidates obligations but also paves the way for those with consistent income to retain valuable […]

Embarking on the journey of navigating Chapter 7 bankruptcy, individuals find themselves at a crossroads of financial restructuring and newfound hope, often encountering a bankruptcy trustee who plays a crucial role in the liquidation bankruptcy process, ensuring that creditors are treated fairly and unsecured debt is addressed according to the law. The filing process under […]

Navigating the tumultuous waters of financial upheaval requires clarity and structure, and bankruptcy filing documents serve as essential tools in this process, with the bankruptcy petition often being the critical first step towards achieving a legal resolution to insurmountable debt. These forms, which are integral to Chapter bankruptcy paperwork, break down the complex nature of […]

Navigating the complexities of debt relief assistance requires careful consideration, especially when it comes to the task of selecting a bankruptcy assistance provider, as the preparation of Chapter documentation is a meticulous process that can significantly affect the prospects of a financial fresh start. The right provider can facilitate your bankruptcy filing process, ensuring a […]

Facing the complexities of financial insolvency, individuals find solace in personal bankruptcy services that offer a pathway to debt relief and a new beginning. Seeking the expertise of debt relief lawyers who possess a profound understanding of bankruptcy law is crucial when devising a strategic approach to navigate through financial insolvency. These legal experts are […]

Amid the tumult of financial distress, the bankruptcy means test stands out as a crucial tool, providing individuals with a clear gauge of their eligibility for relief under the bankruptcy code, especially when determining if they meet the income threshold for Chapter 7 bankruptcy. This test is integral to the process, as it helps to […]

When sinking in a sea of bills, many turn to debt settlement programs as their life raft, hoping to negotiate their way to financial breathing room, while others explore bankruptcy alternatives to find a more drastic but potentially liberating solution to their fiscal woes. This approach allows individuals to work with companies that aim to […]

Taking a significant hit, and the bankruptcy remains on your credit report for 7 to 10 years, making it challenging to move forward with a Chapter 13 repayment plan. With careful planning and by adhering to the correct steps, you can make the process as seamless as possible. Here are some tips on how to […]

After recovering from bankruptcy, the road to restoring your financial health can seem daunting, but with disciplined debt management and consistent efforts to improve your credit score, financial stability is within reach. The pursuit of credit repair entails a series of deliberate and strategic actions that can lead to significant improvements over time. While the […]

In the labyrinth of financial woes, the automatic stay acts as a beacon of hope, providing beleaguered debtors with a critical respite, while bankruptcy protection paves the way for an orderly financial reorganization. Enshrined in bankruptcy law, this provision triggers a powerful suspension of creditor activities the moment a bankruptcy case is filed, offering instant […]

In the intricate framework of insolvency laws, debtors who find themselves in the tumultuous process of bankruptcy are provided with significant safety nets known as exemptions, ensuring that despite the liquidation of some assets, individuals can still achieve a financial fresh start without being entirely stripped of their means of living. These legal measures serve […]

Navigating the complex world of financial distress, the seasoned guidance of a bankruptcy attorney shines as a beacon of hope for individuals seeking to regain financial stability, often leading them to the doorsteps of a bankruptcy law firm renowned for providing legal bankruptcy solutions and compassionate chapter advisory. Bankruptcy law offers various chapters tailored to […]

In the complex and nuanced procedure of converting assets to liquid assets, understanding the optimal timing is crucial, particularly when navigating the intricacies of asset divestiture and adhering to stringent insolvency regulations. This understanding is central to a successful asset liquidation process. A meticulously managed asset disposal strategy is dependent not only on the market’s […]