If you’re grappling with debt, it’s natural to feel overwhelmed. Filing for bankruptcy can seem a daunting prospect, often leading people toward alternative insolvency solutions. Envisioning a fresh start could mean navigating multiple strategies. Consider working with credit advisory services for your first step. These services offer invaluable financial counseling. This approach imparts understanding in […]

Navigating financial challenges as a couple requires open discussion and proper financial insolvency guidance for pairs. The crux of the problem often lies within miscommunication and a scarcity of proper advice on marital bankruptcy, which is often neglected. Wealth planning, an essential aspect, can significantly benefit from these marital bankruptcy tips, aiding in overcoming financial […]

Financial hardships and monetary struggles, a common reality for students, often escalate due to accumulating educational debts. Just when the situation seems desperate, the thought of bankruptcy emerges. But understanding its effect on academic life, particularly in the context of financial guidance for learners, is essential. Many myths surround the concept of student debt. Misconceptions, […]

Increasing financial hardships among seniors have spurred a strong interest in elderly debt counseling. Bankruptcy, often misunderstood, is one option that offers potential senior citizen debt relief. This article aims to unravel the mystery around bankruptcy, spotlighting how it can support struggling seniors. Medical bills, exorbitant living costs, and diminished financial resources are common triggers. […]

Facing financial distress is daunting, often compelling individuals to opt for either bankruptcy or debt consolidation. Bankruptcy, a legal strategy, could relieve most obligations, providing an opportunity for a fresh fiscal beginning, typically via asset liquidation. This usually results in ‘financial insolvency’. On the other hand, debt consolidation, a wise debt management approach, unites various […]

Understanding the complex relationship between bankruptcy and credit rating often leads to misconceptions. For instance, during periods of financial distress, an individual’s credit rating can dramatically alter. This significant shift is directly linked to the borrower’s perceived solvency. An individual in financial distress appears less creditworthy, triggering a drastic decrease in their credit rating. So, […]

Navigating the bankruptcy filing process is a complex task, particularly for individuals grappling with financial insolvency. Understanding the ins and outs of this journey is crucial for a successful outcome. Primarily, two types of personal bankruptcy come into play: Chapter 7 bankruptcy and Chapter Each has unique impacts and implications on the debtor’s financial landscape. […]

Encountering financial distress can compel individuals or businesses to embark on the challenging journey of filing bankruptcy. At this juncture, understanding the Bankruptcy Code is critical for making an informed choice as it classifies the different types of insolvency into chapters. The first principal form, personal insolvency, is commonly referred to as ‘Chapter Liquidation. ‘ […]

In today’s intricate financial climate, a fundamental grasp of bankruptcy regulations equips individuals with powerful knowledge. Bankruptcy, a concept often cloaked in confusion, forms a core pillar of worldwide financial systems. This legal process allows individuals or businesses grappling with insolvency statute knowledge to either annihilate their debts or repay them, under the defense provided […]

The severity of today’s economic landscape can result in financial hardship, which can, unfortunately, lead to insolvency, an intimidating predicament. A beacon of hope in overcoming these obstacles is the assistance of a reliable debt advisory service. These services function as your gateway to financial freedom by providing bankruptcy counseling. The convenience offered by online […]

Bankruptcy is a legal path providing relief from debt. The process is complex, demanding the selection of top insolvency lawyers. These experienced professionals are integral to successfully navigating this daunting financial landscape. Bankruptcy has profound implications. Thus, the importance of a premier debt relief advisor is underscored. This advisor’s role involves preserving your rights throughout […]

Many corporations are facing the tumultuous seas of financial struggle, a reality that can be weathered by identifying signs of ‘Insolvency guidance for enterprises’ early. This strategy can significantly steer the situation towards a more sustainable path. Temporary downturns, often circumvented through ‘Corporate financial distress consultation,’ should not be confused with chronic financial issues. Understanding […]

Facing financial insolvency, a phase often misconstrued, can cause significant distress. This situation, where your liabilities outweigh assets, occurs during certain periods, adversely affecting your credit rating. Therein, acquiring bankruptcy guidance becomes critical to navigate these turbulent times. Experts, armed with superior insolvency tips, work towards dispelling misconceptions, helping you overcome financial crises and offering […]

The process of company insolvency can be an intimidating period for any business, necessitating a thorough understanding of the reorganization plan. This financial reorganization strategy can act as a powerful turnaround mechanism, capable of transforming a corporation’s financial standing. Gaining an in-depth comprehension of this strategy is crucial, propelling an organization through the necessary procedures […]

Bankruptcy in the business world has undergone profound transformations. These updates, particularly corporate insolvency updates, show more renowned firms navigating intricate financial conditions. Impacting these situations, the evolution of bankruptcy law becomes crucial. Analysis of notable business bankruptcy cases illuminates significant trends and provides new insights. The focus shifts to another vital area, the constantly […]

The complex notion of bankruptcy, more specifically Chapter 11 bankruptcy, carries profound implications for businesses and the encompassing economy. Comprehensive understanding and interpretation of ‘Bankruptcy filings data’, forms the core of our analysis. These data patterns provide insight into potential ‘Economic crisis indicators’. This form of bankruptcy, known as Chapter 11, has a dedicated legal […]

Financial hardship, commonly known as insolvency, typically arises when individuals or corporations are unable to meet their financial obligations, compelling debtors to seek out various debt relief alternatives. One frequently chosen path is through insolvency proceedings in the Chapter Bankruptcy Court. This systematic process, classified as restructuring debt, has numerous prerequisites and involves several parties. […]

Financial distress can extraordinarily impact one’s life, invoking stress and hindering their routine. In such precarious situations, a lifeline emerges in the form of bankruptcy, which helps effectively manage financial predicaments, thanks to the pivotal role played by a bankruptcy legal advisor. The insolvency counsel, specializing in bankruptcy matters, holds extraordinary significance. With manifold duties, […]

Chapter-style bankruptcy consultation, your lifeline in a dire financial crisis, offers tailored ‘debt restructuring advice’. This advice is invaluable, providing a stable platform from which to navigate financial troubles. Aiding in both protection and relief, the insolvency legal services guide you in mastering business insolvency and comprehending its potential impact efficiently. But insightful understanding is […]

Chapter Bankruptcy can have significant consequences, such as corporate insolvency, so understanding these intricacies is essential when exploring alternatives. This financial decision can lead to business liquidation, a detrimental outcome. A comprehensive evaluation of the business’s financial health and long-term objectives can highlight alternative routes. One such promising route is debt reorganization, a method that […]

Numerous misconceptions about bank insolvency frequently taint the concept of bankruptcy, particularly Chapter 7 bankruptcy. Such false beliefs about business bankruptcy can make the journey to financial recuperation appear more daunting than it should be. One prevailing myth suggests that it severely damages your credit, an assumption that is not always correct. This myth falsely […]

Bankruptcy often appears as a complex, inscrutable ordeal, puzzling those seeking insolvency advice. Understanding the core principles of the process can shed light, unraveling its mysteries. A catalog of different types exists, the most notable being the Chapter category – Chapter 7, 11, 12, and 13 – each governed by unique debtor possession laws that […]

The precarious nature of business insolvency significantly impacts the financial ecosystem. Hence, insolvency analysis of Chapter bankruptcy cases is a critical step to understand its profound effect. This thorough examination illuminates the severity of financial distress and assists in formulating effective strategies to counter similar predicaments in future scenarios. In the sphere of bankruptcy laws […]

Embarking on the journey of debt relief can be quite daunting, especially when it comes to understanding the complexities of bankruptcy discharge. This typically represents the closing phase of a bankruptcy case, offering a form of financial restructuring to those in need, providing a beacon of solace. Peeling back the layers of bankruptcy, we encounter […]

In the insolvency administrator role, the Chapter Bankruptcy Trustee holds a critical position. One of their key responsibilities is to oversee the debtor’s assets and assess their financial standing. Diligently abiding by bankruptcy code provisions, the trustee applies a detail-oriented methodology to managing the financial reorganization process. The trustee’s role becomes pivotal when the bankruptcy […]

Grasping the concept of Chapter Bankruptcy involves appreciating insolvency proceedings. Essentially, it’s a financial reorganization strategy devised to aid insolvent businesses in clearing their financial obligations. This reorganization method is a legal course of action undertaken in a bankruptcy court, wherein a detailed inspection of the debtor’s liabilities and assets is performed. The ultimate goal […]

Bankruptcy, and more specifically personal insolvency, is a term that often carries a sense of dread. In the vulnerable economic climate we’re experiencing, it’s become a necessary tool for many seeking financial relief. Individual financial reorganization, also known as Chapter-type bankruptcy under US bankruptcy law, equips debtors with a financial lifeline when facing insurmountable financial […]

For companies considering insolvency proceedings, the first step is understanding bankruptcy fundamentals as a legal tool. It allows for business reorganization, managing debts under the watchful eyes of a bankruptcy court. There’s a broad array of bankruptcy types, each influencing future operations of a company. Businesses often select Chapter bankruptcy when repaying creditors becomes a […]

Corporate bankruptcy is inherently a severe issue, impacting far beyond mere company insolvency. This substantial challenge in the business sphere carries serious implications, presenting more than just direct financial difficulties. It is, therefore, pivotal to explore, not only the triggers that precipitate this organizational meltdown, but also the cascading impact that a commercial collapse can […]

Undertaking the bankruptcy filing process is a complex endeavor, requiring a comprehensive understanding of the ins and outs of this legal procedure. Among the most essential components are the Chapter Bankruptcy forms. These are legally binding documents whose accurate completion and submission are vital. Diverse forms of bankruptcy are recognized, each symbolized by a varying […]

Navigating the labyrinth of bankruptcy terminology is important due to the financial impacts insolvency regulations can bring. Bankruptcy, a legal status craved by individuals or companies unable to pay their debts, requires nuanced understanding. Several types of bankruptcy exist, each with their individual features, necessitating bankruptcy reorganization advice from professionals. Uniquely standing on the bankruptcy […]

Venturing into Chapter bankruptcy triggers crucial financial implications. Bankruptcy filing fees, acting as an appreciable preliminary cost, are one of them. These encompass court dues and administrative expenditures, although these aren’t the only ones. Chapter bankruptcy presents expenses regularly overlooked, including Debt restructuring expenses. These additional costs accumulate when you modify your fiscal obligations to […]

Chapter Bankruptcy, often viewed as an insolvency process timeline, brings a clear path for financially distressed corporations to structure their debts efficiently. A corporate bankruptcy schedule sets the base for these struggling companies to find stable ground again. In the initial stages, the debtor seeks credit counseling from an approved agency, which is a vital […]

Comprehending Chapter Bankruptcy can be challenging yet necessary as financial distress may arise unexpectedly. As a debtor, understanding each step in the filing process is key, specifically due to unfavorable effects of bankruptcy such as an instant impact on personal finances. These implications of liquidation reverberate long-term, particularly in your credit score. This reality could […]

Chapter bankruptcy, generally misunderstood, offers numerous insolvency advantages, including a fresh start mechanism for debtors struggling financially. By viewing it through the lens of Debt reorganization, you can appreciate the silver lining it offers those mired in debt. Often stigmatized, the Chapter bankruptcy model provides substantial Financial restructuring benefits, countering the prevalent misconceptions. It is […]

Chapter bankruptcy, often a lifeline, provides relief to individuals grappling with unmanageable debt. The bankruptcy code criteria of this financial solution are often misunderstood, sparking the need for an in-depth exploration. Understanding the ins and outs of Chapter bankruptcy offers valuable insights into eligibility. The complex insolvency filing conditions constitute a crucial aspect of Chapter […]

Recognizing financial distress is a crucial part of understanding your bankruptcy options. This allows you to see bankruptcy not as a failure, but as a strategic route towards financial restructuring. The journey towards financial recovery often begins here. Two common personal bankruptcy methods offer distinct advantages and repercussions, each requiring careful consideration. The first method […]

Bankruptcy can feel like navigating a maze for businesses under financial distress, but it’s a strategic decision rather than a chaotic one. Sometimes, bankruptcy protection becomes the only viable route to safeguard the company against creditors, helping to alleviate ongoing financial struggles. Often, when other remedial measures prove inadequate, businesses commence insolvency proceedings. This situation […]

The Bankruptcy Code, formulated under federal law, provides a necessary relief pathway for individuals and businesses dealing with financial distress. It encompasses different chapters, one of which is Chapter This financial strategy is often utilized by corporations aiming to revitalize their business model and emerge from the labyrinth of Insolvency with renewed strength. A close […]

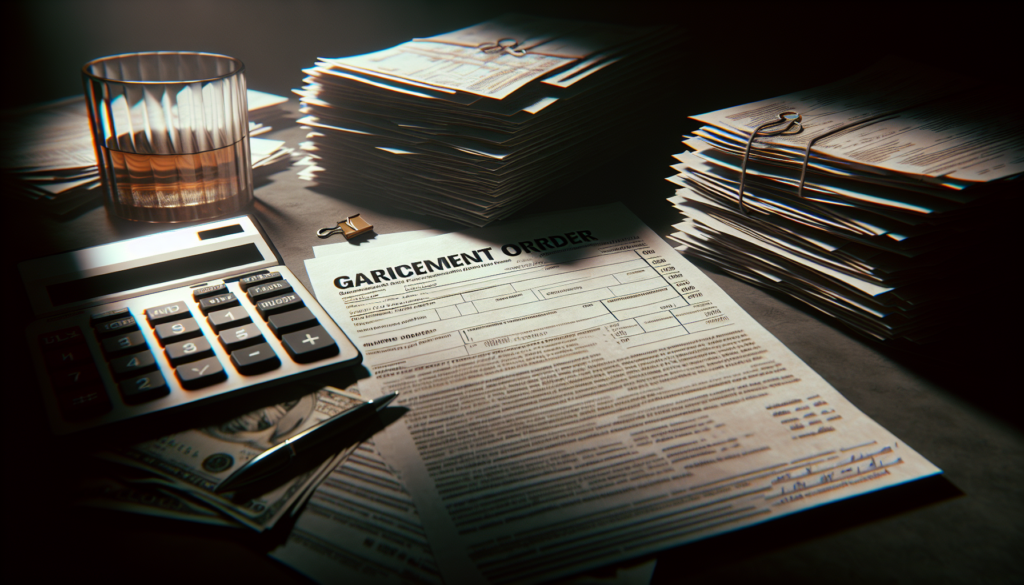

Navigating your options amid salary attachment and multiple debt holders can seem daunting, especially when dealing with wage garnishment. Being subjected to payroll deductions due to wage garnishments necessitates a keen understanding of your options. A viable strategy here could be initiating negotiations with multiple creditors in order to manage your circumstances effectively. The concept […]

Wage garnishment, also called income seizure, can be a complex issue to understand thoroughly. Essentially, it is a process where part of a person’s earnings is withheld to pay off debts. This generally comes as a consequence of a court judgment. But, situations do exist where paycheck garnishment may occur without a court order. These […]

Appreciating the complexities between wage garnishment and liens is vitally important for your financial stability. Wage Garnishment, also recognized as income attachment, is a lawful process where a fraction of a person’s income is held by their employer for debt repayment. This is typically the course of action for debts such as child support, student […]

Wage garnishment, often described as Salary Attachment, is a legal route chosen by creditors to recover their owed money. This mechanism relies on Payroll Deduction, which subtracts a predetermined amount from an individual’s income. Typically, this arises from obligations like student loans, tax defaults, or outstanding credit card balances. The path of an Earnings Garnishment […]

Grasping the concept of wage garnishment primes the pathway towards ‘paycheck seizure resolution’. Wage garnishment – a court-ordered process where a part of an employee’s income is held back by their employer for debt repayment, is crucial to understand. This scenario arises from varied causes, such as unpaid child support, defaulted student loans, or outstanding […]

Grasping the wage garnishment process, a prime payroll seizure solution, is indeed the initial movement towards monetary freedom. Wage garnishment, or payroll seizure, denotes a court-mandated income reduction aimed at debt repayment. It becomes essential to understand how this type of earnings attachment can substantially influence your personal finances and overall lifestyle. The pathway to […]

Navigating the complexities of wage garnishment requires a firm grasp on the ‘salary withholding rate’. This legal process results in a portion of a person’s earnings being kept by the employer to settle a debt. Knowledge about the ‘paycheck deduction portion’ is vital both for employers and employees. The amount deducted from the paycheck is […]

Wage garnishment is a legal process where a ‘payroll deduction notice’ is issued, signifying a portion of a debtor’s earnings will be withheld by their employer. This is a conventional mechanism for creditors to recover unpaid debts and is often experienced by individuals with unresolved financial obligations, such as student loans or unpaid taxes. The […]

Wage garnishment, often referred to as wage seizure or income seizure arrangement, is a significant issue impacting numerous individuals. It involves a legal process where a portion of a person’s salary is withheld to fulfill a debt or obligation. The laws and procedures pertaining to salary seizures vary based on jurisdiction and debt nature. Recognizing […]

Grasping the essence of ‘salary withholding restrictions’ is essential for both employees and employers. These wage garnishment limits ensure a delicate equilibrium, offering income security for workers while sanctioning necessary deductions. ‘Garnishment cap’ directly impacts these salary deductions, reflecting careful measures to avoid exploitation of the worker and limit the organization’s liability. When one explores […]

It’s crucial to grasp the specifics of a wage garnishment hearing, also known as an income deduction order, when one is leveled against you. This procedure, alternatively referred to as a wage seizure proceeding, is implemented to aid creditors in recouping their debts from individuals unable to settle them on their own. The wage garnishment […]

Wage garnishment presents a legal method whereby a slice of an individual’s income is held back by the employer to offset a debt. This process heavily relies on ‘income withholding orders,’ which unequivocally detail the debtor’s obligations. Understanding the fundamental aspects of wage garnishment necessitates the comprehension of decisive documents such as ‘payroll garnishment paperwork. […]

In trying times of financial adversity, your salary may become a direct bullseye. This is where salary seizure safeguards and the concept of wage garnishment come into focus. Wage garnishment is a legally instituted process that permits creditors to obtain court orders. These orders withhold a part of your income to clear outstanding debts. To […]

Wage garnishment represents a lawful process typically arising from court judgments, tax levies, or income withholding orders. This process involves the deduction of money directly from an employee’s income, a practice known as paycheck deductions, and these deductions serve the purpose of benefitting the debtor. Throughout this garnishment process, employers assume a critical role, functioning […]

Knowing your rights associated with wage deductions is paramount in the current workforce, primarily dictated by income withholding laws. The process of understanding these laws governing salary deductions shouldn’t be overlooked as it entails critical legislative aspects surrounding your pay. The procedure to execute salary deductions incorporates multiple steps carefully governed by paycheck levy rules. […]

Delving into the concept of wage garnishment, or more aptly termed as ‘income seizure for tax liabilities’, offers an eye-opening perspective into financial planning. This procedure, most commonly recognized as earnings confiscation, comes to the forefront when an authoritative entity, like a court, mandates an employer to withhold a designated sum from an employee’s income […]

Income withholding forms a critical pillar in child support enforcement. This approach involves Noncustodial Parent Salary Deduction to ensure the child’s needs are met. While many might view this as putting an undue burden on the noncustodial parent, it’s crucial to highlight benefits such as consistent child support payments and reduced arrears. Child Support Enforcement […]

Wage garnishment is often used as a final measure by collectors when student loan repayment obligations remain unsettled. This refers to a legal procedure in which your employer withholds part of your income, also known as income withholding, to meet your defaulted education loan demands. A comprehensive understanding of the process leading to wage attachment […]

Wage garnishment, or as it’s otherwise known, earnings withholding, represents a legal framework that enables creditors to claim a specific percentage of an employee’s earnings. The primary impetus behind income garnishment rules revolves around debt repayment. Laws related to wage garnishment, which include paycheck levy legislation, differ significantly across various states. The initiation of wage […]

The Federal Wage Garnishment Laws constitute a vital part of the US salary garnishment statutes that govern our country’s employment and financial ecosystems. Primarily, these income withholding regulations function to maintain a legal channel enabling creditors to recover debts directly from the debtor’s paycheck. These governing principles necessitate an employer’s rigid adherence to paycheck deductions […]

Navigating the legal maze surrounding wage deductions often proves challenging for employers. A critical aspect is calculating vital deductions like salary garnishment, where a payroll deduction tool plays an instrumental role every 11th step of the way. Such tools are purpose-built to calculate applicable wage deductions, ensuring compliance with myriad legal requirements. From factoring in […]

Wage garnishment represents a challenging financial predicament, often culminating in a complex labyrinth of seeking bankruptcy protection. Individuals burdened with income withholding due to unsettled debts, taxes, or child support, find their payroll deductions escalating to unbearable levels. In many instances, this predicament leaves them with a singular recourse – debt discharge via bankruptcy. Chapter […]

Gaining a grasp on the concept of wage garnishment can enormously impact your income protection. This legal process allows creditors to directly subtract money from an employee’s paycheck to settle overdue debts. The implication of this wage garnishment extends beyond simple wage deduction prevention. It affects one’s ability to protect income and amplifies any financial […]

The wage garnishment process, operating within the sphere of legal debt recovery, is an instrumental method known as income withholdings or earnings seizure. It is initiated by a court judgment, compelling an employer to perform paycheck deductions from the debtor’s earnings. This setup orchestrates interactions between multiple parties – courts, employers, and creditors, with each […]

Grasping the concept of wage garnishment, or as it’s also known ‘earnings withholding’, may appear complex for beginners. This rule refers to paycheck deductions mandated by law to satisfy outstanding debts. An age-old practice bearing significance, it’s crucial for everyone, particularly newbies in fiscal matters, to understand its nuances. Mastering the legal parameters encompassing income […]

Comprehending the severity of wage garnishment, commonly referred to as ‘Income Attachment’, is imperative for gaining perspectives on its significant effects. This financial burden has a profound impact on individuals and families, leading to the prospect of ‘Paycheck Seizure’ that disrupts both financial stability and lifestyle. It’s critical to know your rights under legal provisions […]

When struggling with financial insolvency, management of financial resources may resemble an endless, uphill battle. Especially when facing the intersection of bankruptcy and necessary utility costs. Overdue gas bills and electricity bill arrears can accumulate, further complicating the situation. This often leads to significant disruption in the provision of these vital public services. Essential to […]

Over recent years, there has been a concerning escalation in occurrences of insolvency linked to medical debt, drawing serious attention. This is primarily attributed to the skyrocketing costs associated with healthcare, which burden individuals with unexpected expenses, leading to financial jeopardy. The undeniable connection between medical bills and financial instability, signifying the importance of debt […]

Facing financial distress can hinder your ability to secure an auto loan default, as lenders often scrutinize your credit rating. Nonetheless, insolvency and vehicle financing can coexist, it’s not a door closing on your chances. Conquering financial upheavals, while securing an auto loan is indeed achievable. Consider John’s situation; despite grappling with Chapter implications, he […]

Navigating the complex maze of bankruptcy and taxes involves a deep dive into the sector of financial insolvency. This field is enmeshed closely with tax-related intricacies, needing careful navigation. A thorough understanding of the impact on personal or corporate financial obligations is crucial when dealing with debt relief strategies tied to fiscal distress. The relationship […]

Navigating the matrix of financial obligations, such as alimony payments, after a debilitating fiscal downturn can be incredibly daunting. Debt discharge is a significant aspect in such cases, and understanding the interplay of this with alimony obligations becomes imperative. Alimony payments can be significantly influenced in situations related to financial insolvency, a state often emerging […]

Navigating the complex world of financial insolvency can be a daunting experience, especially when it involves obligations to child maintenance payments. This situation calls for critical restructuring of one’s finances to effectively manage and eventually pay off debts. Often, this endeavor can have a direct effect on alimony payments, making it crucial to understand the […]

Navigating marital separation finances can be a daunting task, often leading to severe financial hardships. The complex process of debt dissolution can frequently leave individuals grappling with insurmountable bills, and in some cases, insolvency after breakup. The financial issues arising from this situation can have numerous and devastating consequences. Acquiring a deep understanding of these […]

Financial distress in matrimony is an unfortunate verity that can often introduce complexities into relationships. Couples may find themselves enveloped in disagreements over issues like spousal debt. These stressful circumstances can be defused or prevented by promoting transparency and fostering open communication. Experiencing insolvency during wedlock can yield a double-edged sword of repercussions. It’s not […]

Experiencing bankruptcy is undoubtedly more than a financial dilemma. It’s an emotionally challenging phase that inflicts enormous burdens. Yet, the concept of a fresh start after financial crisis, like postbankruptcy travel, serves as a beacon that propels many to move forward. Traveling post-bankruptcy is a unique approach to set foot on the path of recovery. […]

The economic toll of student loan obligations has burgeoned into a multifaceted conundrum. Debt relief for education often seems inaccessible, with the weight of student debt discharge being a serious concern. Limited alternatives coupled with the complex nature of financial obligations drive many into considering bankruptcy as a solution. The intersection of insolvency and educational […]

Bankruptcy can often complicate housing options, particularly when it comes to leasing post-insolvency. The financial aftermath of bankruptcy can create substantial obstacles in securing a lease. It’s crucial to familiarize yourself with bankruptcy tenant rights, as this knowledge can potentially expand your options despite seemingly restrictive circumstances. Even after declaring bankruptcy, there is light at […]

When an individual is declared bankrupt, it profoundly influences their insurance policies, marking an essential connection between bankruptcy and insurance. This Financial Insolvency can result in stark modifications to various forms of insurance, particularly as Debt Relief measures continue to surge. Diverse insurance policies undergo alterations when one declares bankruptcy – life, health, homeowners, and […]

Despite the severe implications of bankruptcy on personal finance, especially on retirement plans, it’s not the end of the world. Encouragingly, a pathway to financial recovery post-bankruptcy exists, presenting individuals in this situation a fresh start. Bankruptcy undeniably impacts retirement savings, but knowing the magnitude and methods to mitigate it is crucial. Fortuitously, pension planning […]

Emerging from bankruptcy carries an undeniable impact, both emotionally and socially. Often, the stigmas and misconceptions surrounding this experience can deepen the stress. It’s essential, however, to perceive bankruptcy as an opportunity for financial recovery, not as a disastrous conclusion. Post bankruptcy, the vista of revitalization awaits. This period can serve as a platform to […]

Bankruptcy might seem like a major setback, but it presents an opportunity for financial recovery. Develop consistent habits to adapt to postbankruptcy savings, transforming this seemingly difficult phase into a stepping stone towards financial stability. Making growth your primary goal can help to deter the recurrence of detrimental behaviors. The lifeline here is adept insolvency […]

Navigating life post-bankruptcy presents both a challenge and an amazing opportunity for financial recovery post-insolvency. This fresh start, though it may appear daunting initially, is a unique chance to revive your economic prospects. Performing a detailed assessment of your financial situation following such a setback is of paramount importance. By using appropriate tools and methodologies, […]

Financial distress and marriage is a dance that often twirls partners into an emotional whirlwind. Bankruptcy, a notable source of financial stress, has a profound manifestation within relationships, causing emotional turbulence. Precariously balancing on this fault line, the mutual trust in a relationship often crumbles under severe money issues, causing a drastic alteration in relationship […]

Embarking on the journey of financial recovery post-bankruptcy can initially seem overwhelming. With structured planning and a firm grasp of your financial situation, the road to recovery becomes more manageable. To begin, understanding the real impact of bankruptcy is a crucial first step. Dispelling the myths about life after insolvency and acknowledging the tangible effects […]

Financial distress often triggers a wave of negative emotions, leading to intense psychological pressure. This distress is not merely a financial issue; it unveils an often-overlooked connection between bankruptcy and mental health, typically manifesting as crippling anxiety and depression. Research shows a strong correlation between insolvency and mental disorders, further reinforcing this overlooked link. Those […]

Bankruptcy might seem like a daunting setback, nonetheless, it doesn’t denote the end of your entrepreneurial aspirations. Take it as the starting point for your journey towards post-bankruptcy entrepreneurship. The path may not be smooth, but by initiating a startup after financial collapse, you can turn your fortunes around. Key to your success is understanding […]

The complex intersection of insolvency and employment often leads to misunderstandings. Many perceive bankruptcy as synonymous with financial ruin, overlooking its role as a legal instrument for debt relief. Bankruptcy, presented in various forms, carries distinct implications for your current employment and future job prospects. Contrary to widespread belief, it’s illegal to be fired due […]

The first step in claiming a fresh start after bankruptcy is understanding the impact it has on you, particularly in terms of ‘rebuilding credit.’ This challenging yet crucial part of your recovery entails developing a sound strategy for ‘post-bankruptcy budgeting. ‘ Such a strategy is pivotal in forestalling past mistakes, thus enabling you to make […]

Embarking on a journey towards fiscal recuperation might seem daunting, especially in the context of personal insolvency. The task of securing a home loan post-bankruptcy, however, is not an insurmountable feat. The aftermath of bankruptcy carries substantial implications, particularly in the realm of credit standing. Yet, contrary to popular misunderstandings, the mortgage qualification following bankruptcy […]

Navigating through bankruptcy leaves a considerable mark on your financial journey and credit score. Nonetheless, credit recuperation post-insolvency is not just a dream but a feasible reality, presenting an opportunity for a brand-new start. The entire process of bankruptcy, alongside its implications and immediate impact on your credit score, becomes a significant concern to address. […]

Starting anew after debt liquidation offers a unique prospect for revitalization. The financial and emotional aftermath will likely be challenging, but think of it as resetting your existence after a financial crisis — a chance to learn from past mistakes and avoid repeating them. Embracing the postbankruptcy life changes brings its share of hardships. Nevertheless, […]

In the aftermath of filing for bankruptcy, you might find yourself adapting to a post-bankruptcy lifestyle that requires both resilience and stringent planning. This new beginning, often viewed as a fresh start, presents an opportunity to rectify past errors by reassessing your financial health. The common misconception is that bankruptcy symbolizes an end. The reality […]

Delving into the complexities of debt elimination offers an underlying dimension – the emotional aspect. Understanding this aspect brings to light the crucial role that our financial mindset plays in tackling these challenges. Eradicating debt is not only about practical solutions; it necessitates managing the emotional turmoil that often accompanies this daunting journey. The experience […]

Living the ‘zero debt life’ is an endeavor many aspire to achieve, but often misinterpret as synonymous with ‘frugal living’. It’s not all about austerity, but rather a journey towards financial freedom, rooted in economic discipline. Attaining a lifestyle devoid of debt isn’t merely a conceptual dream. Instead, it’s a tangible reality for those shackled […]

The oppressive prevalence of debt, often a crushing burden, can profoundly affect emotional wellbeing. Nevertheless, debt reduction testimonies offer a beacon of hope. Personal debt mitigation stories firmly underline the attainability of total debt elimination. Among these triumphant individuals, some had grappled with daunting debt figures for years, shedding light on financial freedom narratives. Ordinary […]

Implementing debt reduction strategies is an essential approach towards achieving financial liberty. These strategies require a keen understanding of financial obligations, which sets the foundation for fiscal guidance for liability clearance. Whether it’s a credit card debt, student loan, or mortgage, staying informed about your debts, and income is a key aspect of money management […]

Debt payoff apps, embodiments of advanced financial management software, represent a revolutionary way to navigate financial responsibilities. The meteoric rise of such apps indicates a substantial paradigm shift towards achieving fiscal freedom. Embedded within these apps are debt elimination tools, simplifying the process of financial planning, and leading to better financial results. These high-performing budgeting […]

Financial Planning is the lifeline for effective credit management. This process sets clear financial goals, carving a debt-free path and showcasing the power of an organized approach. Yet, the journey to eradicating debt isn’t confined to planning. It demands careful execution, often stumbling due to insufficient Fiscal Discipline. Remember, successful Debt Reduction Strategies are more […]

Being trapped under debt’s weight can seem overwhelming. Implementing a proactive ‘debt repayment strategy’ paves the way to regaining financial freedom. A particularly effective method is the Debt Avalanche Technique, a remarkable contrast to the ‘Snowball Method’. The key difference lies in the focus on ‘highest interest first’ debts. To fully reap the benefits of […]

Achieving the much-coveted financial freedom is far from a leisurely stroll in the vast park of monetary matters. It necessitates adopting a potent financial strategy. One particularly favored approach, the ‘Snowball Method’, serves as a potent debt repayment plan. Emphasize focusing on the little things, this technique encourages paying off smaller snowballing debts. This strategy […]

Living through a personal debt crisis is an exhausting experience, affecting not just one’s financial stability, but also triggering emotional discomfort. Managing personal economy becomes a critical concern in such situations. Understanding your debt is the first step to resolution and an essential aspect of financial health improvement. Unraveling the root cause of the accumulation […]